The moment Mohammed bin Salman sat down to talk with 60 Minutes, it was only a matter of time before crude rose.

Well, he certainly didn’t disappoint.

Between casual comments calling Ayatollah Khamenei “the new Hitler” of the Middle East and confirming that if Iran pursued a nuclear bomb, Saudi Arabia would follow suit as soon as possible, he also defended his move to jail some of the richest men in the world until they were willing to give up more than $100 billion.

Meanwhile, not a word was spoken on Qatar.

But it’s clear that the Saudi royal family knows its oil wealth won’t last forever.

Truth is, they know exactly how close they are to that crisis. Of course, until they decide to release their closely guarded oil field data, all we can do is speculate.

What we can see is the oil-rich country making some pretty serious moves away from oil.

Saudi Arabia is already planning to shell out $80 billion over the next 25 years to build 16 nuclear reactors. This is on top of the aggressive investments it’s making to develop renewable sources like solar.

Can the House of Saud see the writing on the wall?

Maybe.

The New Oil Order

Hey, at least we can’t say OPEC didn’t have a good run.

But to quote the 60 Minutes interview from the other day, there’s a new sheriff in town.

While some OPEC members like Venezuela are struggling to prevent oil production from collapsing entirely (spoiler: they won’t), others are quite content to keep crude between $70 and $80 per barrel for the rest of the year.

And then we have the United States…

I’ll tell you right off the bat that not all oil plays were created equal.

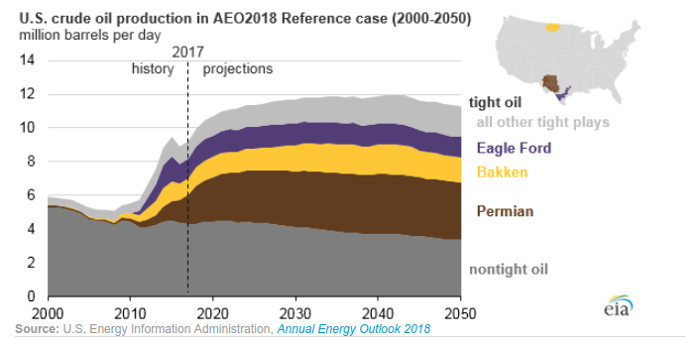

That rings especially true for the United States, but it’s more than simply tight oil vs. conventional oil. The disparity between the tight oil plays in the Lower 48 is staggering.

Let me show you what I mean:

As you can see, tight oil makes up more than half of our domestic oil production; just three tight oil plays accounts for roughly 36% of our total crude output.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

And that share is going to increase going forward.

Trust me, dear reader, this isn’t simply by chance.

So I have to ask who you think will be the biggest winners as the United States ramps up its oil exports?

Ever since the ban was lifted, exports have surged, averaging 1.1 million barrels per day in 2017.

I told you a few weeks ago that there was one spot that was perfect for Texas crude: China.

And if you think we have a severe oil addiction here in the U.S., imagine how much worse off we’d be if the shale boom had never happened?

If that were the case, we would have to wipe more than 8.2 million barrels per day off the books in 2018!

Gone. Kaput.

Without the shale boom, U.S. oil production would be at a level not seen since the 1940s.

That’s precisely the position China is in right now. China’s oil output has already dropped by nearly 2% this year, averaging less than 4 million barrels per day; this is the lowest it’s been in more than six years.

This year, China will have to import about 9 million barrels per day to keep pace with demand.

And this is where we come in…

When we’re talking exports, our two biggest customers were Canada and China, which together imported more than half a million barrels of crude from the U.S.

But like I said, this addiction is going to get stronger in the coming years.

In the last three months of 2017, our Chinese oil exports averaged 348 million barrels per day.

Now, let me ask you this…

Where do you think producers like Venezuela will turn when their production collapses entirely?

Next week, we’re going to delve into the new world oil order, and you might be surprised at who makes the list.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.